Loan Insights

How Commercial Loans Can Help Improve Cash Flow for Small Businesses

Cash flow is the lifeblood of any business, but for small businesses, managing it effectively can be particularly challenging. Irregular revenue streams, seasonal fluctuations, and unexpected expenses can strain even the most carefully planned budgets. Commercial loans provide a practical solution to these challenges by offering access to the financial resources needed to stabilize cash […]

The Impact of Interest Rates on Commercial Loans: What Business Owners Need to Know

Interest rates are one of the most significant factors affecting the cost and accessibility of commercial loans. For business owners, understanding how interest rates influence loan terms, repayment obligations, and overall financial strategy is critical. Whether rates are rising, stable, or declining, their impact can shape borrowing decisions and long-term business planning.

Exploring Different Types of Commercial Loans: Finding the Best Fit for Your Business Needs

Access to capital is critical for businesses looking to grow, expand, or navigate financial challenges. Commercial loans offer a diverse range of options tailored to meet the unique needs of businesses in various industries. Choosing the right type of loan is essential for achieving your goals while maintaining financial stability. This guide explores the different […]

The Role of Commercial Loans in Financing Startups and Expanding Businesses

Commercial loans play a pivotal role in the journey of entrepreneurs and business owners. From launching startups to scaling established companies, these financial tools provide the essential capital needed to drive growth and innovation. By bridging the gap between ambition and financial capability, commercial loans enable businesses to achieve their goals and secure long-term success.

Top Benefits of Using Commercial Loans to Grow Your Business

In today’s competitive market, growth is essential for businesses looking to stay relevant and profitable. However, scaling operations, entering new markets, or upgrading infrastructure often requires significant financial resources. Commercial loans provide businesses with the capital needed to achieve these goals without disrupting cash flow or straining operational budgets. By leveraging commercial loans effectively, business […]

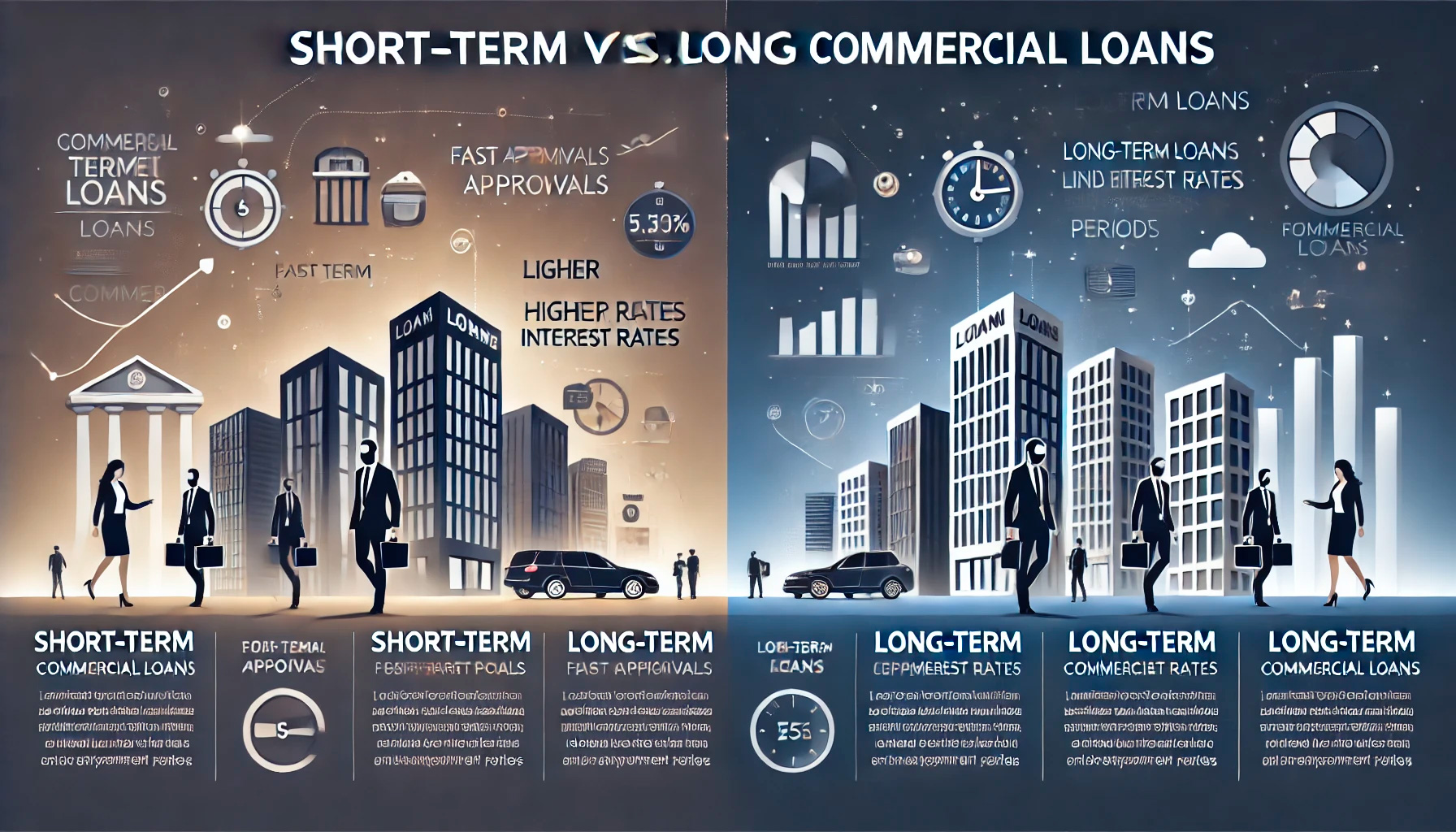

Short-Term vs. Long-Term Commercial Loans: Which Is Right for Your Business?

For business owners, securing the right type of financing is often the key to achieving growth and maintaining stability. Whether you need capital to address immediate needs or fund a long-term project, choosing between short-term and long-term commercial loans is a critical decision. Each option serves distinct purposes and comes with unique advantages and challenges. […]

Understanding Commercial Loans: A Comprehensive Guide for Business Owners

Commercial loans are a vital financial tool for business owners, enabling them to start, grow, and sustain their enterprises. Whether funding expansion, purchasing equipment, or managing cash flow, commercial loans provide the necessary capital to achieve business goals. However, understanding the nuances of these loans is essential for making informed decisions and ensuring long-term success.